Donating stock is an easy way to support LUNGevity’s activities and may also have favorable tax advantages for the donor.

If someone has owned stock for more than one year and that stock has gone up in value (appreciated), they can donate the stock to a nonprofit, get a deduction equal to the fair market value of the stock at the time of the transfer (its increased value), and never pay capital gains tax on the appreciated value of the stock.

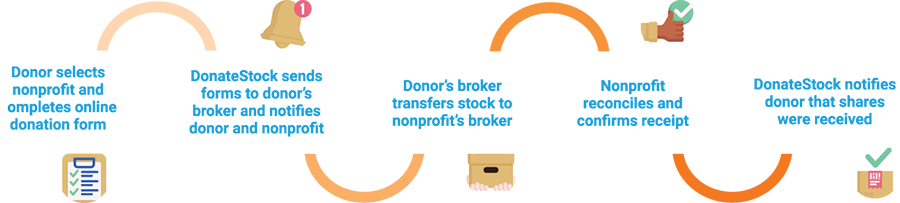

LUNGevity uses a service called DonateStock to process stock donations quickly and easily. The process is simple – just click on the link, provide your broker information, and DonateStock takes care of the rest.

Here's how it works: